income tax rates 2022 south africa

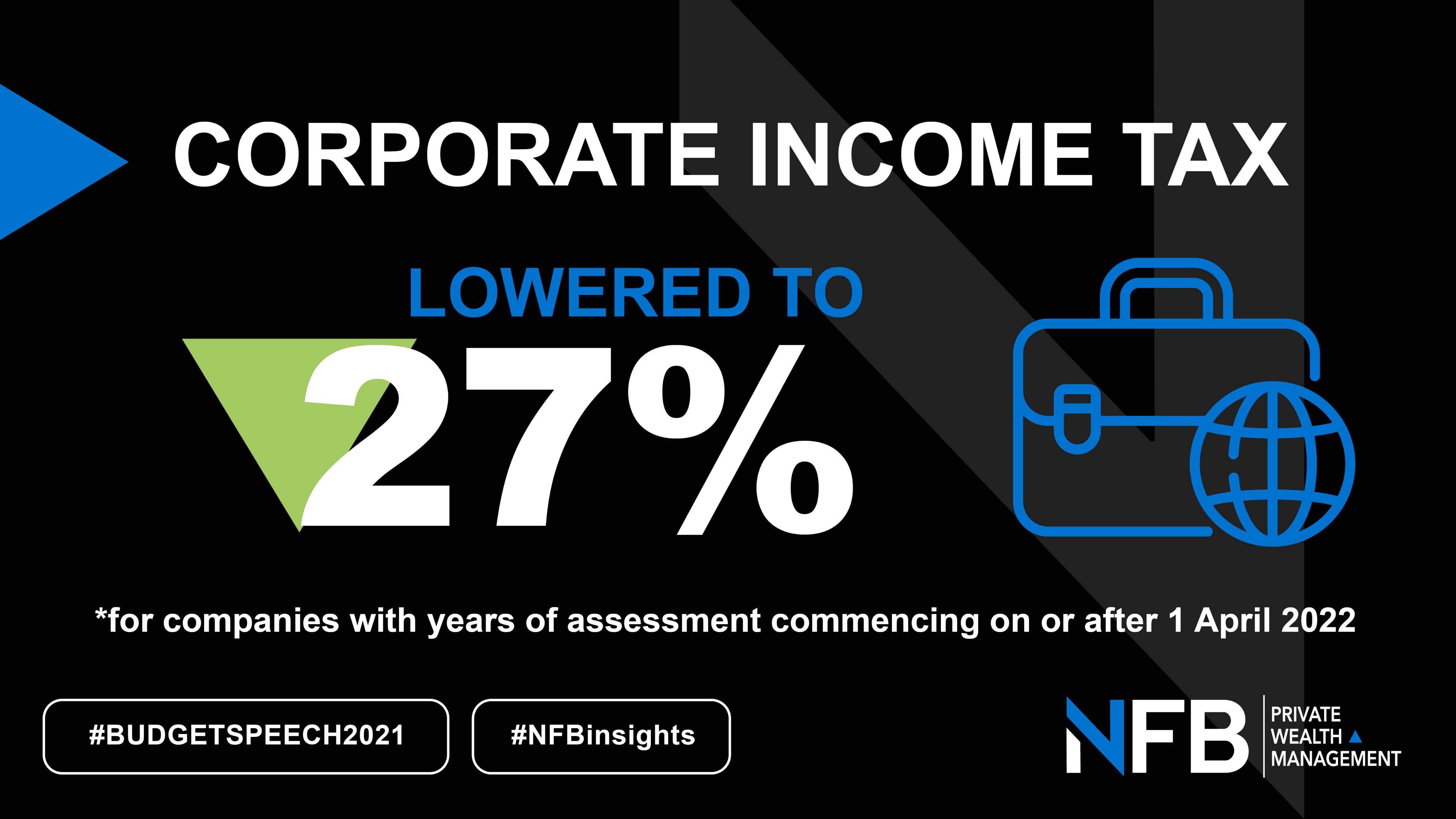

Reduction in corporate income tax rate and broadening the tax base. A South African SA-resident company is subject to CIT on its worldwide income irrespective of the source of the income.

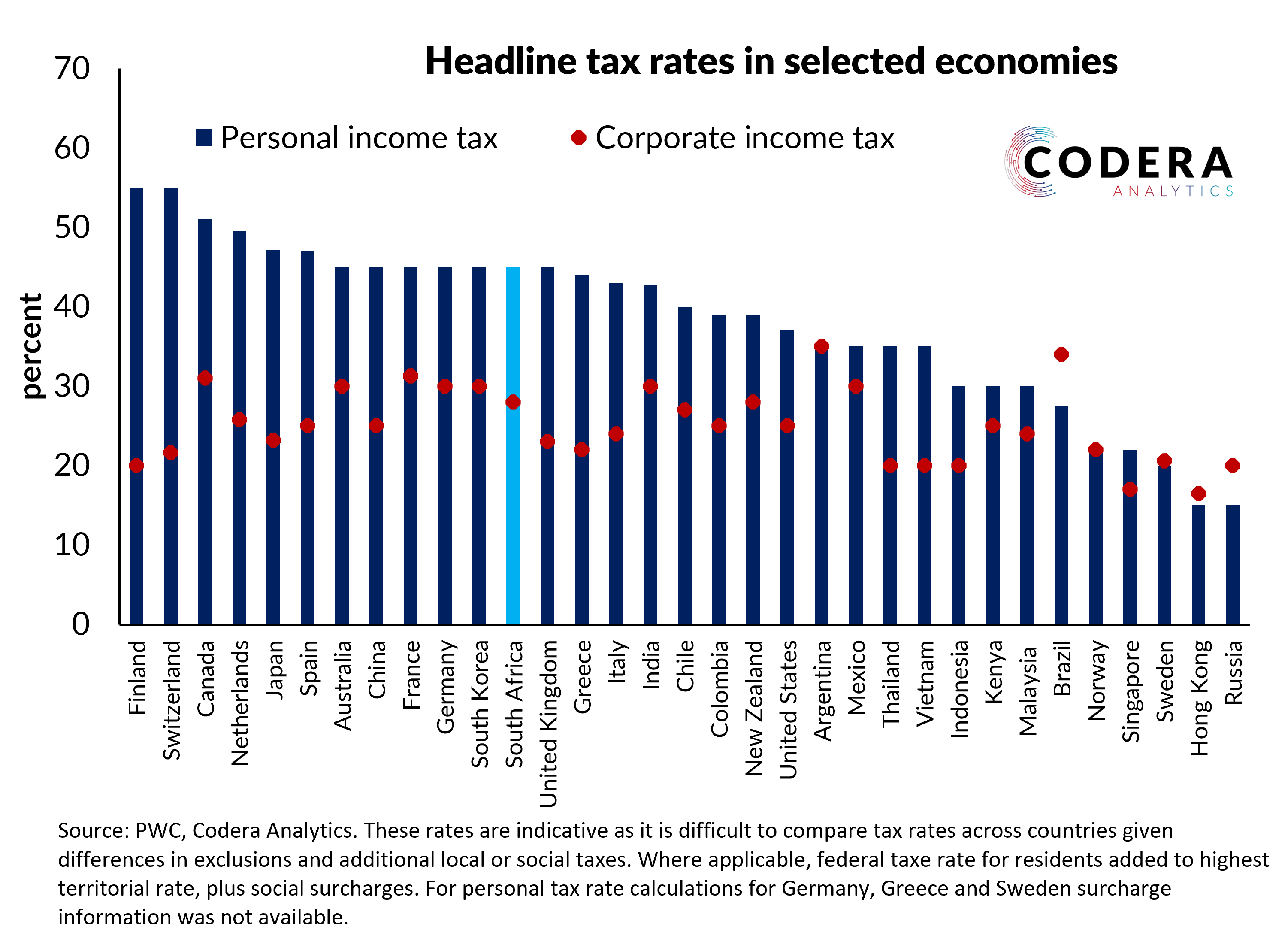

Corporate Tax Rates Around The World Tax Foundation

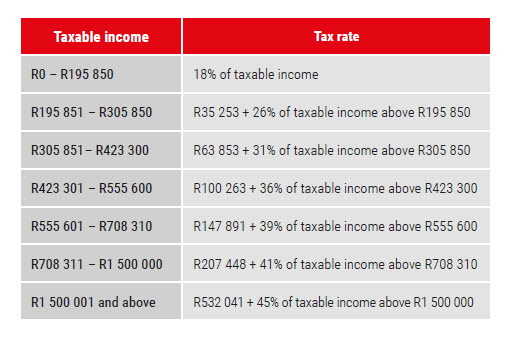

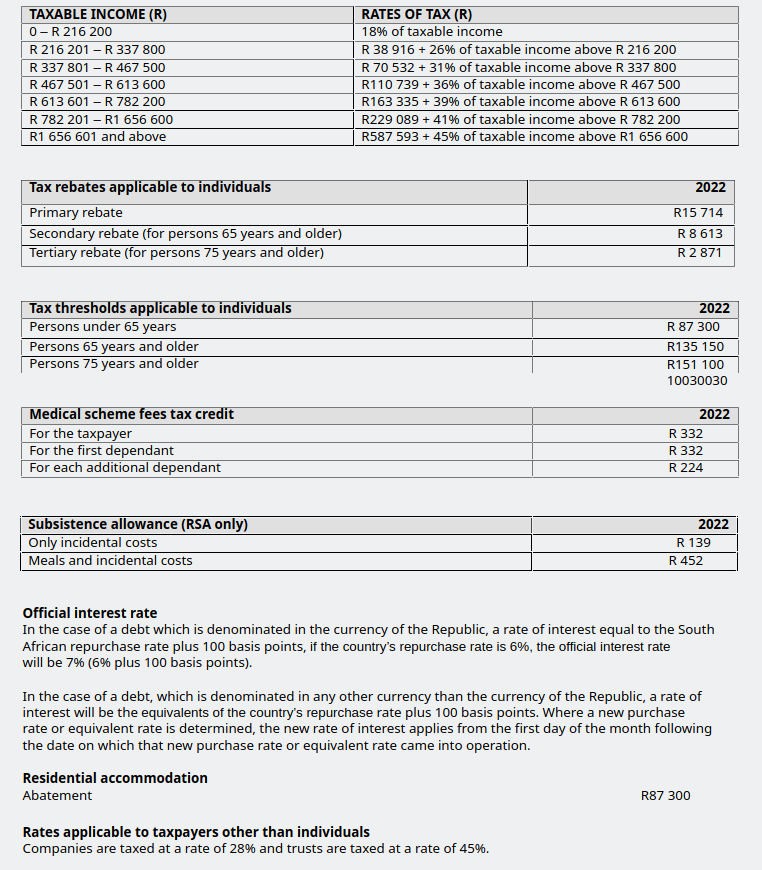

Taxable Income R Rate of Tax R 1 91 250 0 of taxable income.

. Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year. Income Tax Rates and Thresholds Annual Tax Rate. In this section you will find the tax rates for the past.

The current South African tax year runs from 1 March 2022 to 28 February 2023. 29 June 2022 The South African Revenue Service SARS has made significant changes to the 2022 Tax Filing Season. 8 rows Non-residents are taxed on their South African sourced income.

International Tax South Africa Highlights 2022. Many of the leading GDP-per-capita nominal jurisdictions are tax havens whose economic data is artificially inflated by tax-driven corporate accounting entries. For the latest tax developments relating to South Africa see.

91 251 365 000 7 of taxable. 18 of taxable income. Personal Income Tax Rate in South Africa averaged 4163 percent from 2004 until 2022 reaching an all time high of 45.

Non-residents are taxable on SA-source income. The same rates of tax are applicable to both residents and non-residents. Meanwhile the bracket for 445101 584200 was set at 105429 36 of taxable.

The 2022 budget speech delivered 23 February 2022 announced that the. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Updated January 2022.

Years of assessment ending on any date between 1 April 2022 and 30 March 2023. For instance the Irish GDP. You are viewing the income tax rates.

Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. The Personal Income Tax Rate in South Africa stands at 45 percent. If you are 65 years of age to below 75 years the tax threshold.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. The tax season when people are required to file their income tax returns is typically July to. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa.

Working holiday maker tax rates 202223. 40680 26 of taxable income. Its so easy to.

Calculate how tax changes will affect your pocket. Information is recorded from current tax. 2022 Tax Filing Season.

31125 plus 37 cents for each 1 over. For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if you are younger than 65 years. Progressive tax rates apply for.

Under the 2021 tax brackets set by SARS income above R205900 was due 18 of taxable income. South Africa Residents Income Tax Tables in 2022. Tax on this income.

Sage Income Tax Calculator. This year over 3 million individual non. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate.

How Much You Will Be Taxed In South Africa In 2021 Based On What You Earn

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Oecd Urges Sa To Raise Taxes Sell State Firms Moneyweb

Government Will Not Introduce Any Tax Increase Mboweni Sabc News Breaking News Special Reports World Business Sport Coverage Of All South African Current Events Africa S News Leader

Nfb Private Wealth Management On Twitter The Corporate Income Tax Rate Will Be Lowered To 27 Per Cent For Companies With Years Of Assessment Commencing On Or After 1 April 2022

Allan Gray 2018 Budget Speech Update

Tax Tables For Individuals And Trusts 2022 Tax

Budget 2021 Your Tax Tables Tax Calculator L A

Free Sars Income Tax Calculator 2023 Taxtim Sa

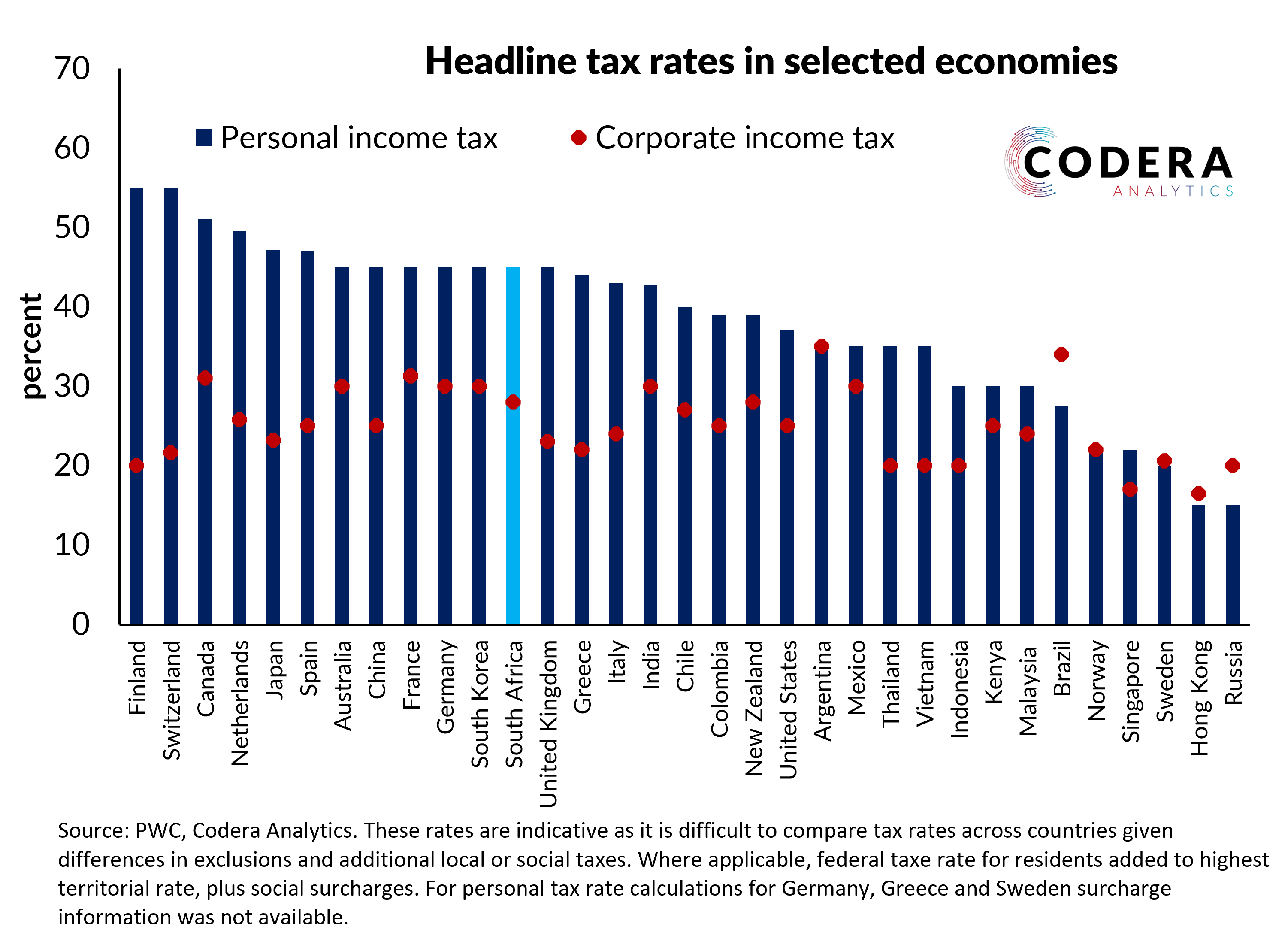

Daan Steenkamp On Twitter South Africa S Headline Personal And Corporate Tax Rates Are Relatively High Compared To The Median Rates Across Major Economies Read More Https T Co H3hzmzsmie Https T Co Jinxowy09u Twitter

Alberta S Tax Advantage Alberta Ca

Tax Season South African Revenue Service

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

3 Alternative Taxes Proposed For South Africa Including Replacing Income Tax

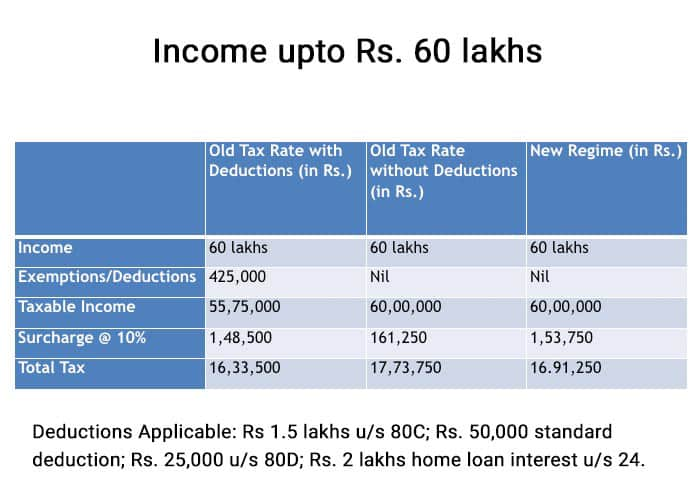

Old Vs New Income Tax Slab Policybazaar

Jalico Accounting Services Budget Speech Summary Corporate Income Tax Rate Will Reduce To 27 From 2023 Tax Year Facebook

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn